Driving the roads of Ohio, from the bustling I-71 corridor to the rural routes of Appalachia, requires more than just a reliable vehicle and a valid license. It requires a solid understanding of your financial responsibilities, starting with your auto insurance policy. For Ohio drivers, navigating the state’s specific insurance requirements, finding affordable rates, and ensuring you have adequate protection can feel overwhelming. This comprehensive guide breaks down everything you need to know about auto insurance Ohio, empowering you to make informed decisions that safeguard your finances and comply with state law.

Understanding Ohio’s Minimum Auto Insurance Requirements

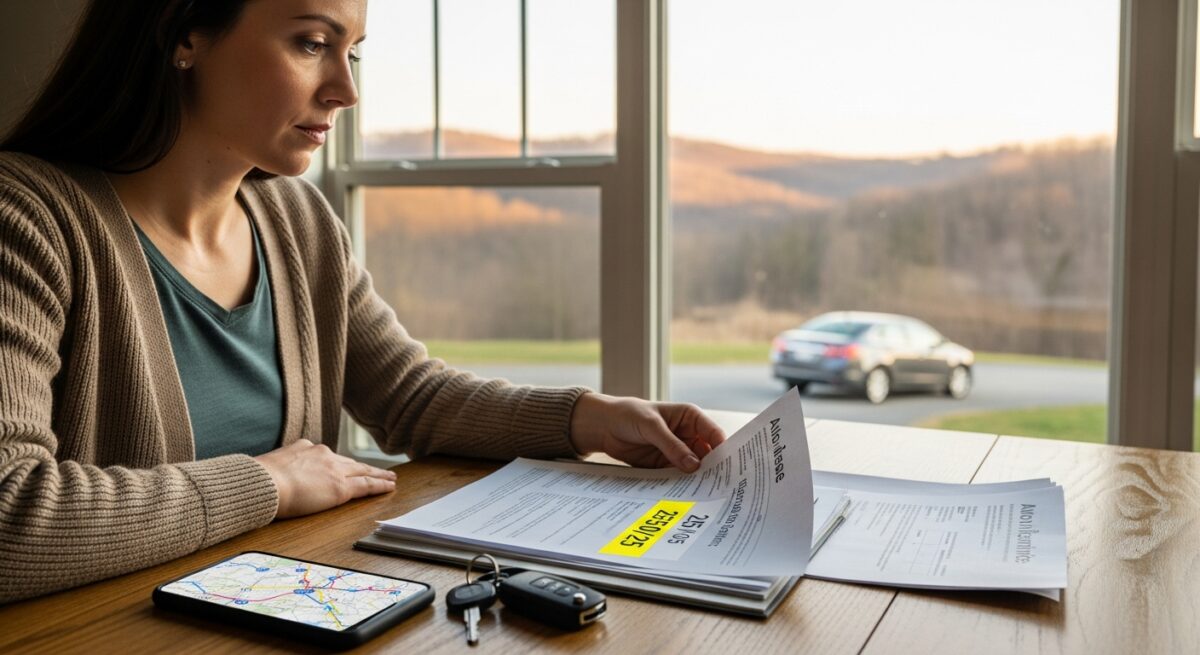

Ohio is a “fault” or “tort” state for car accidents. This means the driver who is legally determined to be at fault for causing a collision is financially responsible for the resulting damages. To ensure drivers can meet this responsibility, Ohio law mandates all registered vehicle owners carry a minimum amount of liability insurance. This coverage does not pay for your own injuries or vehicle damage; it is designed to cover the costs you cause to others when you are at fault. The minimum coverage amounts are often expressed as 25/50/25. It’s crucial to understand that these are the absolute minimums and often fall short in a serious accident. Many insurance and financial advisors strongly recommend carrying limits well above these state-mandated levels to protect your personal assets.

Breaking down the 25/50/25 requirement, we find three core components. First, $25,000 in bodily injury liability coverage per person. This pays for medical expenses, lost wages, and pain and suffering for one person injured in an accident you cause. Second, $50,000 in bodily injury liability coverage per accident. This is the total limit available to cover all injured parties in a single accident you cause. If two people have $30,000 in injuries each, the $50,000 total limit could be exhausted, leaving you personally liable for the remaining $10,000. Third, $25,000 in property damage liability coverage per accident. This covers damage you cause to another person’s property, most commonly their vehicle, but also things like fences, mailboxes, or buildings.

Essential Coverage Options Beyond the Minimum

While liability insurance fulfills the legal requirement, a robust Ohio auto insurance policy includes several other key coverage types that protect you, your passengers, and your own vehicle. Relying solely on minimum liability coverage is a significant financial risk. One of the most important additions is uninsured/underinsured motorist (UM/UIM) coverage. Ohio requires insurance companies to offer this coverage, and you must sign a form to reject it. This protects you if you’re hit by a driver with no insurance or whose liability limits are too low to cover your damages. Given the number of uninsured drivers on the road, this coverage is highly recommended.

Comprehensive and collision coverage are also vital for protecting your investment in your own vehicle. Collision coverage pays for damage to your car resulting from a collision with another vehicle or object, regardless of who is at fault. Comprehensive coverage handles damage from non-collision events such as theft, vandalism, fire, hail, or hitting an animal. If you have a loan or lease on your vehicle, your lender will almost certainly require both. For older vehicles, you may consider dropping these coverages if the cost of the coverage exceeds the car’s value. Other valuable coverages include medical payments or personal injury protection (PIP), which can cover medical expenses for you and your passengers regardless of fault, and roadside assistance, which provides help for breakdowns, tows, and flat tires.

Key Factors That Determine Your Ohio Auto Insurance Rates

Insurance companies use a complex algorithm to assess risk and determine your premium. In Ohio, several specific factors have a significant impact on what you pay. Your driving record is paramount. A history of accidents, speeding tickets, or DUIs will sharply increase your rates. Conversely, a clean record over several years will earn you safe driver discounts. Your age and, to a lesser extent, gender are also considered, with younger drivers, especially teenagers, facing much higher premiums due to statistical risk. Where you live in Ohio matters greatly. Urban areas like Cleveland, Columbus, and Cincinnati typically have higher rates due to increased traffic density, higher accident rates, and greater incidence of theft and vandalism compared to rural areas.

Other critical rating factors include the make, model, and year of your vehicle. Expensive cars, high-performance vehicles, and models with poor safety ratings or high theft rates cost more to insure. Your annual mileage also plays a role; driving fewer miles generally correlates with lower risk. Your credit-based insurance score is a major factor in Ohio. Insurers statistically correlate good credit with responsible behavior and lower claim risk, leading to lower premiums for those with higher scores. Finally, the coverage choices you make the limits you select, your deductibles for comprehensive and collision, and the additional endorsements you add all directly shape your final premium.

Strategies to Lower Your Auto Insurance Premiums in Ohio

Finding affordable auto insurance in Ohio requires proactive effort. The single most effective step is to comparison shop. Rates can vary dramatically between companies for the exact same driver and vehicle profile. Obtain quotes from at least three to five insurers, including both large national carriers and regional companies. It’s wise to shop around every two to three years. Bundling your auto insurance with other policies, like homeowners or renters insurance, almost always triggers a multi-policy discount that can lead to substantial savings. Increasing your deductible the amount you pay out-of-pocket before insurance kicks in for comprehensive and collision coverage can lower your premium, but ensure you choose a deductible you can comfortably afford in an emergency.

Ask about every discount you might qualify for. Common discounts in Ohio include safe driver, good student, anti-theft device, automatic payment, paperless billing, and paid-in-full discounts. Completing an approved defensive driving course can also earn you a reduction. Maintaining a good credit score by paying bills on time and managing debt responsibly will positively affect your insurance score and your rates. Consider the type of car you drive; opting for a vehicle with strong safety features and a low theft rate can help keep insurance costs down. For strategies focused on saving money, our expert tips on lowering premiums in other states, such as the methods outlined for drivers in auto insurance in Montana, can offer universally applicable advice.

The Claims Process and Protecting Your Rights

If you’re involved in an accident in Ohio, knowing the proper steps is crucial. First, ensure safety: move to a safe location if possible, check for injuries, and call 911 if anyone is hurt. Exchange information with the other driver(s), including names, contact details, insurance company, and policy number. Document the scene thoroughly with photos of vehicle damage, license plates, road conditions, and any visible injuries. Obtain contact information from any witnesses. You must report the accident to your insurance company promptly, even if you are not at fault. Be factual and avoid admitting fault or speculating about the cause.

Cooperate with your insurer’s investigation. They will assign a claims adjuster to assess the damage, determine fault based on Ohio’s comparative negligence rule, and manage the repair or compensation process. If you have collision coverage, you can file through your own insurer to get your car repaired faster; they will then seek reimbursement from the at-fault driver’s company. If you are dealing with injuries, it is highly advisable to consult with a personal injury attorney before providing detailed statements or accepting settlement offers from the other party’s insurance company. An attorney can help ensure your medical costs, lost wages, and pain and suffering are fully valued, a process similar to the guidance provided in our resource on navigating auto insurance in Nebraska.

Frequently Asked Questions for Ohio Drivers

What happens if I drive without insurance in Ohio? Driving without the required liability insurance is a serious offense. Penalties can include fines, license suspension, vehicle impoundment, and required filing of an SR-22 certificate (proof of high-risk insurance) for three to five years, which leads to dramatically higher premiums.

Is Ohio a no-fault state for auto insurance? No, Ohio is a traditional “fault” or “tort” state. The driver who is found to be responsible for causing the accident is liable for the resulting damages.

What is an SR-22, and why would I need one? An SR-22 is not insurance; it is a certificate filed by your insurance company with the Ohio Bureau of Motor Vehicles (BMV) to prove you carry the state’s minimum required insurance. It’s typically required after serious violations like a DUI, driving without insurance, or multiple at-fault accidents.

How does Ohio’s comparative negligence law affect my claim? Ohio uses a “modified comparative negligence” rule with a 51% bar. If you are found to be 50% or less at fault for an accident, you can recover damages, but your compensation is reduced by your percentage of fault. If you are 51% or more at fault, you cannot recover any damages from the other party.

Should I get rental car coverage? Rental reimbursement coverage is an inexpensive add-on that pays for a temporary rental vehicle while your car is being repaired after a covered claim. It is highly recommended if you rely on your car for daily commuting and do not have a ready backup.

Securing the right auto insurance in Ohio is a critical component of responsible vehicle ownership. It’s a balance between meeting legal mandates, protecting your financial well-being, and ensuring peace of mind on every journey. By understanding the state’s unique laws, carefully evaluating your coverage needs beyond the bare minimum, and actively seeking ways to optimize your policy, you can drive with confidence knowing you and your assets are protected. Remember, the cheapest policy is not always the best policy; value is found in comprehensive coverage at a fair price from a reputable provider. For drivers seeking a streamlined approach, exploring options like direct auto insurance companies can be an effective way to purchase coverage without an agent intermediary.

Ensure you’re fully protected on Arkansas roads. Call 📞833-275-7533 or visit Get Your Quote to get a personalized insurance quote today.